As of the beginning of July 2022, more tax changes enter into force that considerably modify the provisions of the Polish Deal. The draft act has been passed and signed by the President. The changes will need to be implemented by employers before payroll payments are made in July. Below you will find the highlights of the amendments.

CONSEQUENCES OF THE CHANGES

For employers (remitters), the new regulations mark the third change in tax rules and the need for another update to payroll and HR systems this year. They have already had to change their software twice since the beginning of 2022. Regulations effective as of January 1 introduced, among other things, the middle class relief. Subsequently, effective January 7, 2022, it was made mandatory to calculate the tax two times, i.e., pursuant to the 2022 and 2021 rules, and withhold it in the lower of the two amounts, so that the employee would be paid a higher salary.

As of July 1, the middle class relief and the requirement to calculate taxes twice will be eliminated. Instead, a new tax scale will be introduced, with rates of 12% and 32%.

CHANGE OF THE PIT RATE

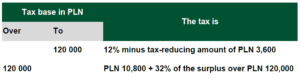

The most important planned change is the reduction of the basic PIT rate from 17% to 12%. With this change, the tax reducing amount will be recalculated. As of July 2022, the tax scale in Poland will be as follows:

The tax-free amount, which is still to be PLN 30,000, remains unchanged. After the PIT rate is reduced from 17% to 12%, the amount reducing the tax will be PLN 3,600 per year (PLN 30,000 x 12%), i.e. PLN 300 per month (1/12 of the PLN 3,600 tax reducing amount).

The new PIT rate is expected to apply as early as in payrolls for July. According to the planned amendments, the income for the entire 2022 is also to be settled according to the reduced PIT rate, so some people may have an overpayment of tax in their annual tax return for 2022 (refund of the overpayment will be made by the tax authorities in 2023).

PIT-2

The new regulations amend the rules regarding application of the tax reducing amount (PLN 300 per month, PLN 3,600 per year). The taxpayer will be able to submit a statement (PIT-2) on the application of the deduction to no more than three remitters. Currently, the regulations provide for such a possibility with respect only to a single remitter.

According to the proposed regulations, in PIT-2 the taxpayer will indicate that the remitter is entitled to reduce the advance payment by one of the following amounts:

- PLN 300 per month (1/12 of the tax reducing amount), or

- PLN 150 per month (1/24 of the tax reducing amount), or

- PLN 100 per month (1/36 of the tax reducing amount).

The new rules enter into force at the beginning of 2023. The PIT-2 statement will also be filed by taxpayers who receive income from civil law contracts and managerial contracts

ELIMINATION OF THE MIDDLE CLASS RELIEF

According to the new regulations, the middle class relief will be eliminated as of July 1, 2022. The middle class relief is for those with their income between PLN 68.4k and PLN 133.6k a year. It ensures that these individuals, despite not being able to deduct the health insurance contribution, do not pay a higher income tax. Due to the complicated algorithm and method of calculating the relief and the resulting tax, administrative and organizational problems, the lawmakers decided to eliminate it. According to the announcement of the Ministry of Finance, those who have taken advantage of the relief will receive greater benefits from the reduction of the PIT rate to 12%.

ELIMINATION OF THE DEFERRAL MECHANISM FOR ADVANCE PAYMENTS

As of January 7, 2022, it was made mandatory to calculate the tax two times, i.e., pursuant to the 2022 and 2021 rules, and withhold it in the lower of the two amounts, so that the employee would be paid a higher salary.

In the majority of cases, this mechanism was beneficial to the employees, as they received higher wages even if they did not file a PIT-2 form or too hastily resigned from the middle class relief. Unfortunately, in some cases the mechanism can result in a large tax surcharge on the annual return.

As with middle class relief, the lawmakers decided to eliminate the above mechanism. According to the announcements of the Ministry of Finance, lowering the PIT rate to 12% will compensate for the possible negative effects of the elimination of the deferral mechanism for advance payments.

HYPOTHETICAL TAX DUE FOR 2022

“Hypothetical tax due” is a new “institution” in tax law that is related to the elimination of the middle class relief. According to the announcement of the Ministry of Finance, those who have taken advantage of the relief (employees with monthly income between PLN 5,701 and PLN 11,141) will receive greater benefits from the reduction of the PIT rate to 12%. Therefore, they should not be affected by the planned changes, because instead of the relief they will pay tax at the lower rate of 12%. However, the Ministry of Finance assumes that this may not be the case in exceptional situations where a person combines the middle class relief with other preferences. It therefore provided for the extraordinary solution of the “hypothetical tax due” in order not to be accused of introducing negative tax changes for taxpayers during the year.

As intended, for taxpayers who would be eligible for the middle class credit, the tax office will calculate the “hypothetical tax due for 2022” under current law (in effect through the end of June). If it turns out that one was to lose due to the elimination of the middle class relief, he or she will be accounted for under the previous, more favorable rules and will be compensated under the same rules under which a tax refund is paid.

SETTLING WITH A CHILD FOR SINGLE PARENTS

As of July 2022, the lawmakers plan to eliminate the relief in the fixed amount of PLN 1,500, which was in effect from the beginning of 2022, and restore the possibility of joint settlement with a child under the rules applicable before 2022.

ENTREPRENEURS (B2B CONTRACTOR). POSSIBILITY TO CHANGE THE FORM OF TAXATION

Due to the planned reduction of the PIT rate to 12%, it may turn out that some persons conducting business activity (B2B contractors), who at the beginning of 2022 opted for the tax on registered income without tax deductible costs or flat-rate tax, will benefit more from taxing their income according to general rules (tax scale).

The lawmakers have provided an extraordinary solution for such taxpayers, i.e. the possibility to change the form of taxation during or after the end of the tax year. It will only be possible to switch from tax on registered income or flat tax to the taxation under general rules (tax scale).

Entrepreneurs settling using tax on registered income will be able to do the switch in two ways, i.e., effective in July, or effective for the entire year 2022. Flat-rate entrepreneurs will only be able to choose the scale effective for the entire year 2022.

ENTREPRENEURS (B2B CONTRACTOR). HEALTH INSURANCE CONTRIBUTION PARTIALLY DEDUCTIBLE

Tax changes that took effect beginning in 2022 eliminated the deductibility of health care contributions. An additional change was made to the rules for calculating health insurance contributions, which now depend on the amount of income earned. The above changes will mostly remain in place, but there are plans to introduce a partial health contribution deduction starting this July. The new solution is provided only for entrepreneurs taxed on the flat rate tax or tax on registered income basis.

According to the new regulations:

- entrepreneurs taxed on a flat rate will deduct health insurance contributions paid from their income, up to a maximum of PLN 8,700 a year (the limit will be indexed annually),

- entrepreneurs paying tax on registered income will deduct from their income half of the health contributions paid.

However, health contribution deduction has not been provided in any form for taxpayers under general progressive tax scale. According to the announcement of the Ministry of Finance, lowering the PIT rate to 12% compensates for the possible negative effects resulting from the lack of deductibility of the health contribution.

In case of further questions regarding this alert, please contact our TPA experts directly.

Łukasz Korbas

Łukasz Korbas

Partner, Accounting & Payroll Outsourcing