By the end of September 2022, real estate companies must report their ownership structure to tax authorities. The reporting obligation applies to real estate companies, as well as their shareholders. For this purpose, the Ministry of Finance has published the relevant forms.

Definition of a real estate company

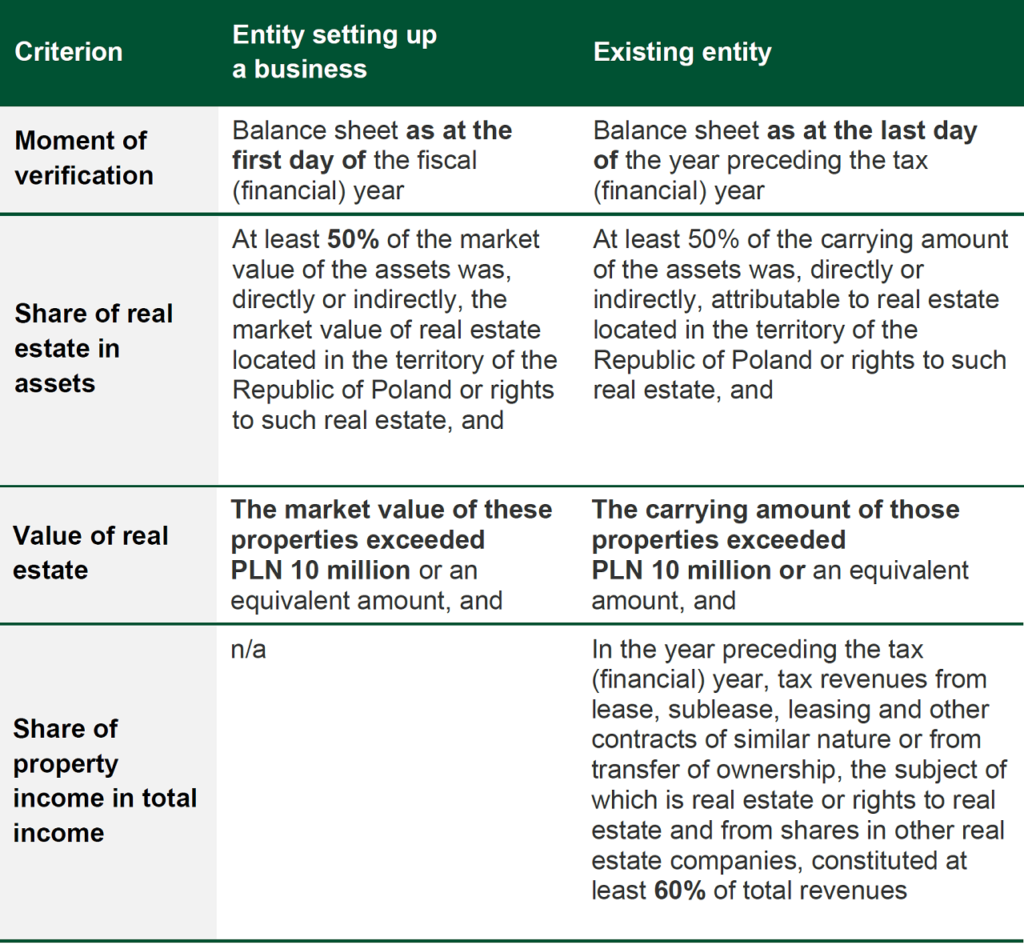

A real estate company is an entity other than a natural person, obliged to prepare a balance sheet on the basis of accounting regulations, in which:

- entity commencing business – as at the first day of the tax year, and if the real estate company is not a taxpayer of income tax – as at the first day of the financial year, at least 50% of the market value of assets, directly or indirectly, was the market value of real estate located in the territory of the Republic of Poland, or rights to such properties and the market value of these properties exceeded PLN 10 million or its equivalent

- an existing entity – as at the last day of the year preceding the tax year, and if the real estate company is not a taxpayer of income tax – as at the last day of the year preceding the financial year, at least 50% of the balance sheet value of assets, directly or indirectly, was the balance sheet value of real estate located in the territory of Poland or rights to such properties and the balance sheet value of these properties exceeded PLN 10 million or the equivalent of this amount and in the year preceding the tax year or the financial year, respectively, tax revenues, and if the real estate company is not a taxpayer of income tax – revenues included in the net financial result, from rental, sublet, lease, sub-lease, leasing and other contracts of a similar nature or from the transfer of ownership, the subject of which are real estate or rights to real estate, and from shares in other real estate companies, accounted for at least 60% of total tax revenues or revenue recognized in profit or loss.

ATTENTION! An entity that is not a Polish tax resident may also meet the definition of a real estate company.

Reporting obligations on the ownership structure of a real estate company

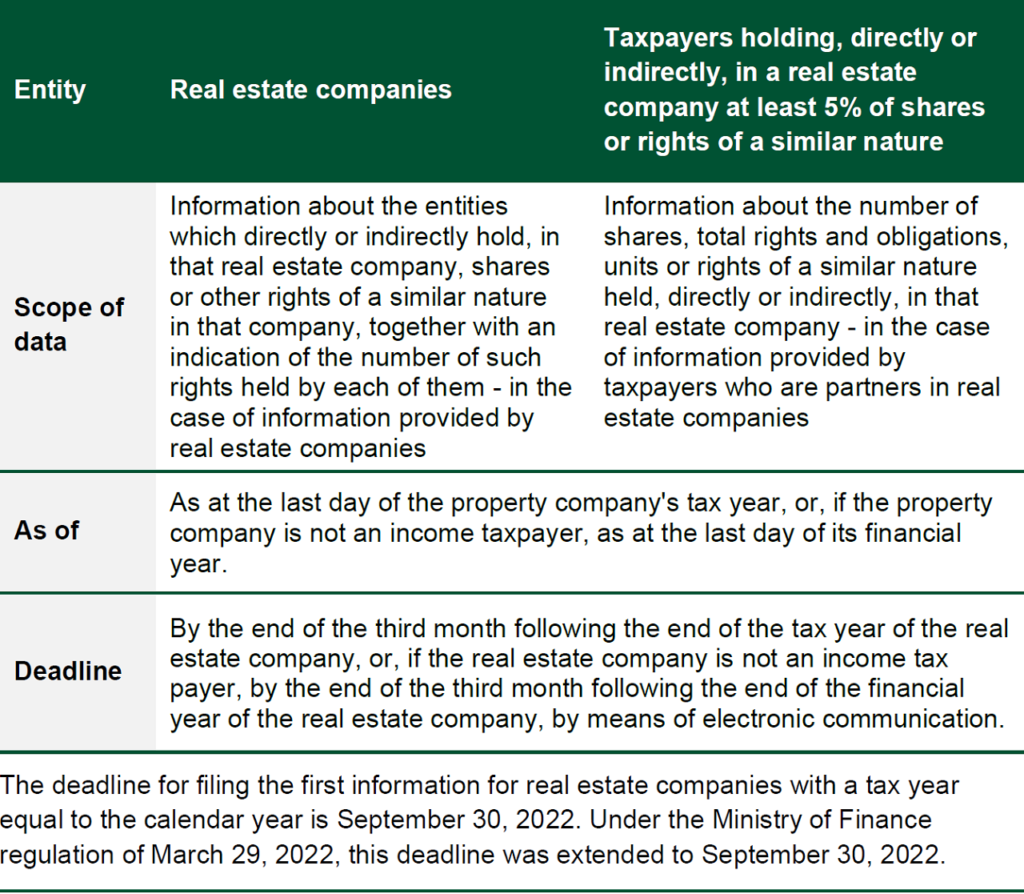

An obligation has been imposed on real estate companies and their direct and indirect shareholders to provide the Head of the KAS (the National Fiscal Administration) with information on entities holding, directly or indirectly, shares, participation titles, all rights and obligations and similar rights in such a real estate company.

The deadline for filing the first information for real estate companies with a tax year equal to the calendar year is September 30, 2022. Under the Ministry of Finance regulation of March 29, 2022, this deadline was extended to September 30, 2022.

Forms

In order to fulfill the statutory reporting obligation, the Ministry of Finance has prepared new information/declaration templates:

- CIT-N1 – information filed by a real estate company about its shareholders,

- CIT-N2 – information filed by a shareholder on the rights held in a real estate company.

The completed return should be submitted electronically to the relevant tax authority.

***

In case of further questions regarding this alert, please contact our TPA experts directly.

Łukasz Korbas

Łukasz Korbas

Partner, Accounting & Payroll Outsourcing

Małgorzata Dankowska

Małgorzata Dankowska

Partner, Tax Advisor

malgorzata.dankowska@tpa-group.pl