On January 7, 2022, the Minister of Finance issued a regulation on extending the deadlines for collecting advance personal income tax payments. The matter in question is the monthly personal income tax advance paid by employees and withheld by employers in the payrolls they prepare.

The regulation is effective as of January 8, 2022, and also applies to payments made between January 1 and January 7, 2022. The extension of the deadlines for the collection of advance payments applies to income earned from January 1 to December 31, 2022 up to PLN 12,800 per month.

THE ISSUE

The main premises of the tax changes included in the Polish Deal program, which came into effect on January 1, 2022, are the increase of the tax-free allowance to PLN 30,000 a year, while raising the tax threshold subject to the 17% rate to PLN 120,000. At the same time, the lawmakers eliminated the possibility of deduction of the health insurance contribution from tax. These changes, along with the inclusion of the middle class tax relief, result in a lower or neutral tax burden for those with earnings of up to 12,800 gross per month.

The above positive or neutral impact of the Polish Deal on employee remuneration applies to the calculation of an employee’s annual income. However, it turns out that in some cases, the amount of the advance income tax payment for January 2022 is higher than that for January 2021, even though the total tax paid by the employee for 2022 will be lower than that for 2021. This is due to a different distribution of the amount of the advance payment in each month of the tax year.

THE REGULATION OF THE MINISTER OF FINANCE AND ITS EFFECTS

Any advance tax payment made after January 7 must be calculated in accordance with the provisions of the new regulation. If an employer (tax remitter) has already paid January remuneration under the previous rules (e.g., December 2021 remuneration paid at the beginning of January 2022), they must recalculate it. In case the collected advance payment was too high – the employer must immediately return the excess to the employee (taxpayer).

The effect of the regulation is the change of the date of collecting the advance tax payment. The regulation specifies what part of the advance payment in a given month is not to be collected and in what month this part of the advance payment is to be collected – if at all.

The postponement of tax advance payment dates applies to income from employment, contract of mandate, retirement and disability pensions. The deadlines for collecting and remitting advance income tax payments to the Tax Office have been extended. The new mechanism applies to months in which revenues for the entire month amounted to no more than PLN 12,800.

Moreover, due to the express mode of enacting this regulation and the need to modify the payroll systems in place, there is an urgent need to update the payroll software in use. In the following steps, it will be necessary to recalculate the payments already made and possibly to refund the unduly withheld tax to employees.

THE NEW MECHANISM FOR CALCULATING AND COLLECTING ADVANCE PERSONAL INCOME TAX PAYMENTS

The regulation establishes a new mechanism for calculating and collecting advance personal income tax payments.

Step 1

Calculating advance income tax payments according to the “new” tax rules (effective as of 2022) and “old” ones (effective until December 31, 2021).

Step 2

Comparing which advance payment is lower – under the old or the new rules.

Step 3

If advance payments under the old rules are greater, the regulation does not apply. However, if the advance payments according to the old rules are lower – the regulation applies and advance payments are collected in

the lower amount (i.e. according to the old rules).

Step 4

The excess between the new and the old rules will be collected at a later date, namely:

- in the month in which a negative difference between advance payments under the old and new rules arises – up to the amount of the difference in the given month, or

- if this does not occur, the taxpayer will account for any excess on his or her annual return.

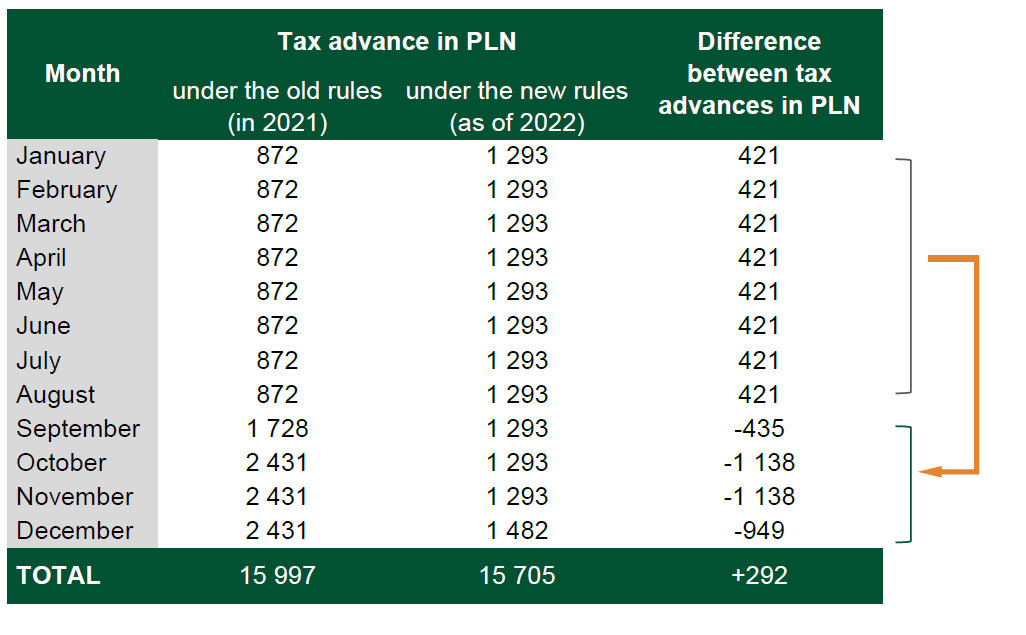

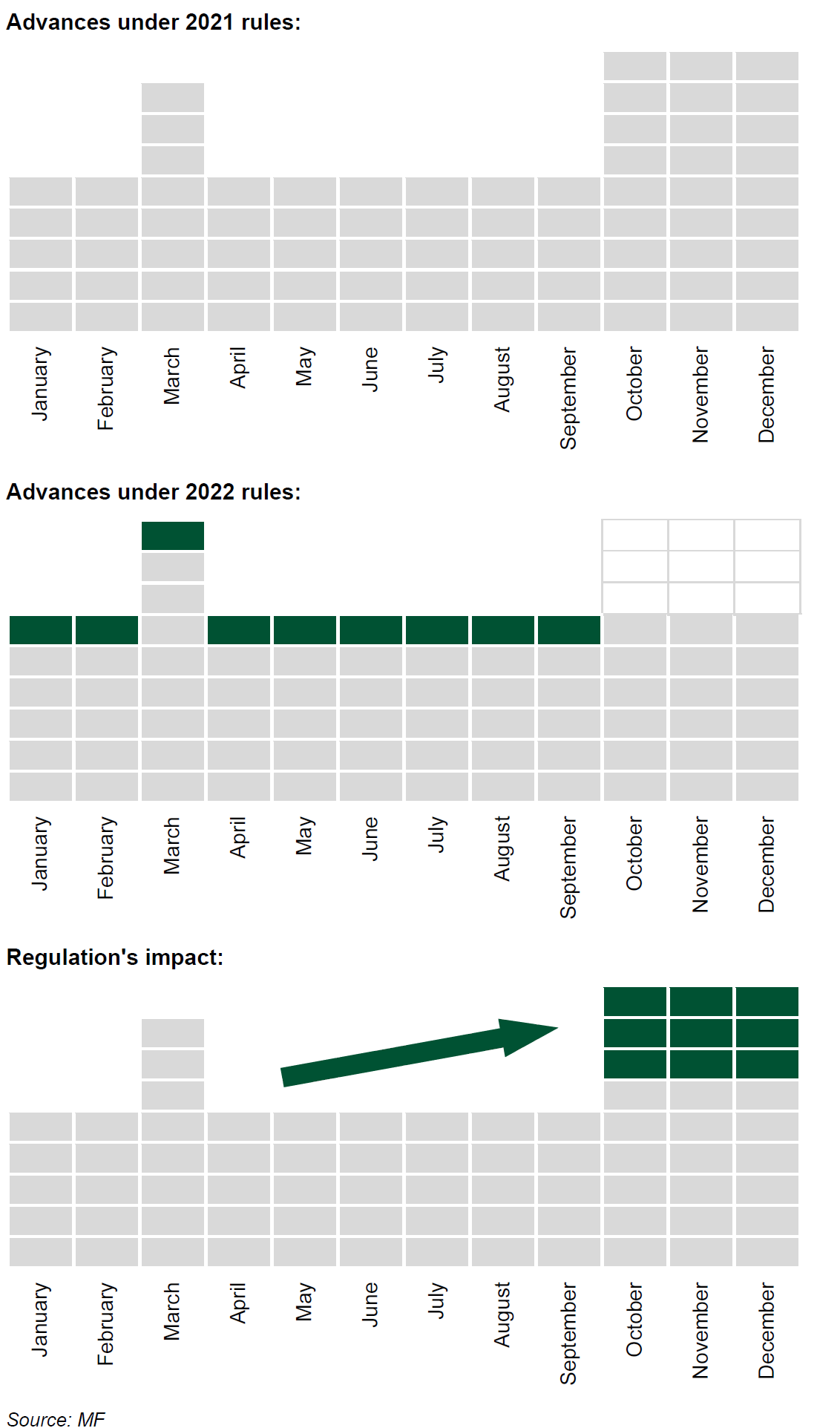

The impact of the regulation can be presented as follows:

Monthly salary from a full-time employment contract in the amount of PLN 12,000 – example:

REQUEST TO NOT APPLY THE NEW TAX ADVANCE COLLECTION MECHANISM

The new rules do not apply when the eligible taxpayer (employee) requests the mechanism to not apply. This is possible when the tax advance is not reduced by 1/12 of the tax reducing amount.

The most common situations where a taxpayer may make such a request are:

- the person is employed in two different companies under an employment contract,

- the person is employed under an employment contract and at the same time runs business activity (settled under general progressive tax regime),

- the employed person receives retirement and/or disability pension from a pension authority.

LEGAL CONCERNS

Issuing the regulation was followed by doubts of a legal nature. Some experts claim that the regulation was issued in flagrant violation of the constitutional order and in violation of the applicable hierarchy of legal acts.

There was no vacatio legis to provide the addressees of the regulation with an opportunity to prepare for the changes introduced. Due to that fact, it will remain impossible to apply for many remitters (employers), at least with respect to current payments.

There is concern that the enacted regulation will exacerbate the legal and informational chaos surrounding changes to the tax system effective as of January 1, 2022.

PIT-2 IN A NUTSHELL

The PIT-2 form is a statement by the employee that authorizes the employer to reduce the advance payment for a given month by the amount that reduces the tax. As of January 1, 2022, every taxpayer with income taxed under general progressive tax regime will benefit from the tax-free amount of PLN 30,000. The previous amount of PLN 8,000 was degressive and was not available to everyone.

In the case of spouses, both spouses are entitled to the tax free allowance – this means that each of them can earn PLN 30,000 tax-free.

Along with the increase in the tax-free amount, the amount reducing tax advances has also increased. As of January 1, 2022, it amounts to PLN 5,100 a year (17% tax on the amount of PLN 30,000), or PLN 425 per month (1/12 of PLN 5,100). In 2021, it was PLN 43.76 per month (1/12 of PLN 525.12).

If the employee does not submit a PIT-2 form to the employer, the tax-free amount will be included in the annual tax return.

CONDITIONS FOR SUBMITTING PIT-2

An employee may submit a PIT-2 to the employer if, in addition to income from employment contract, he or she:

- does not receive retirement and/or disability pension through the remitter, who by virtue of the law, applies a reduction in the advance on that benefit,

- does not draw incomes as a member of farmers’ co-operative or any other co-operative engaged in agricultural production,

- does not earn income taxed under the general progressive tax regime, on which he or she is obliged to calculate the advance income tax (business activity);

- does not receive any benefits from the Labour Fund or Guaranteed Employee Benefits Fund.

If the employee works multiple jobs, the PIT-2 can only be submitted to one employer. Once submitted, the PIT-2 form remains valid for subsequent tax years – until revoked or withdrawn by the employee.

This document was prepared for informational purposes only and is of a general nature. Every time before taking actions on the basis of the presented information, we recommend obtaining a binding opinion of TPA Poland experts.

|