A fixed establishment (hereinafter: “FE”) determines the place where services are subject to VAT.

WięcejEnglish

In our articles we focus on topics related to the current changes in Polish and international law, we analyze the consequences of amendments to tax regulations for taxpayers, and we describe planned developments and their consequences for business. We also focus on issues important for accounting departments, new reporting obligations, pointing out the practical effects of the implementation of the amended regulations on the daily activities of entrepreneurs.

Najnowsze posty

Permanent establishment in Poland – tax consequences

The issue of having permanent establishments by foreign entities (also referred to as PE) in Poland is of considerable interest to tax authorities.

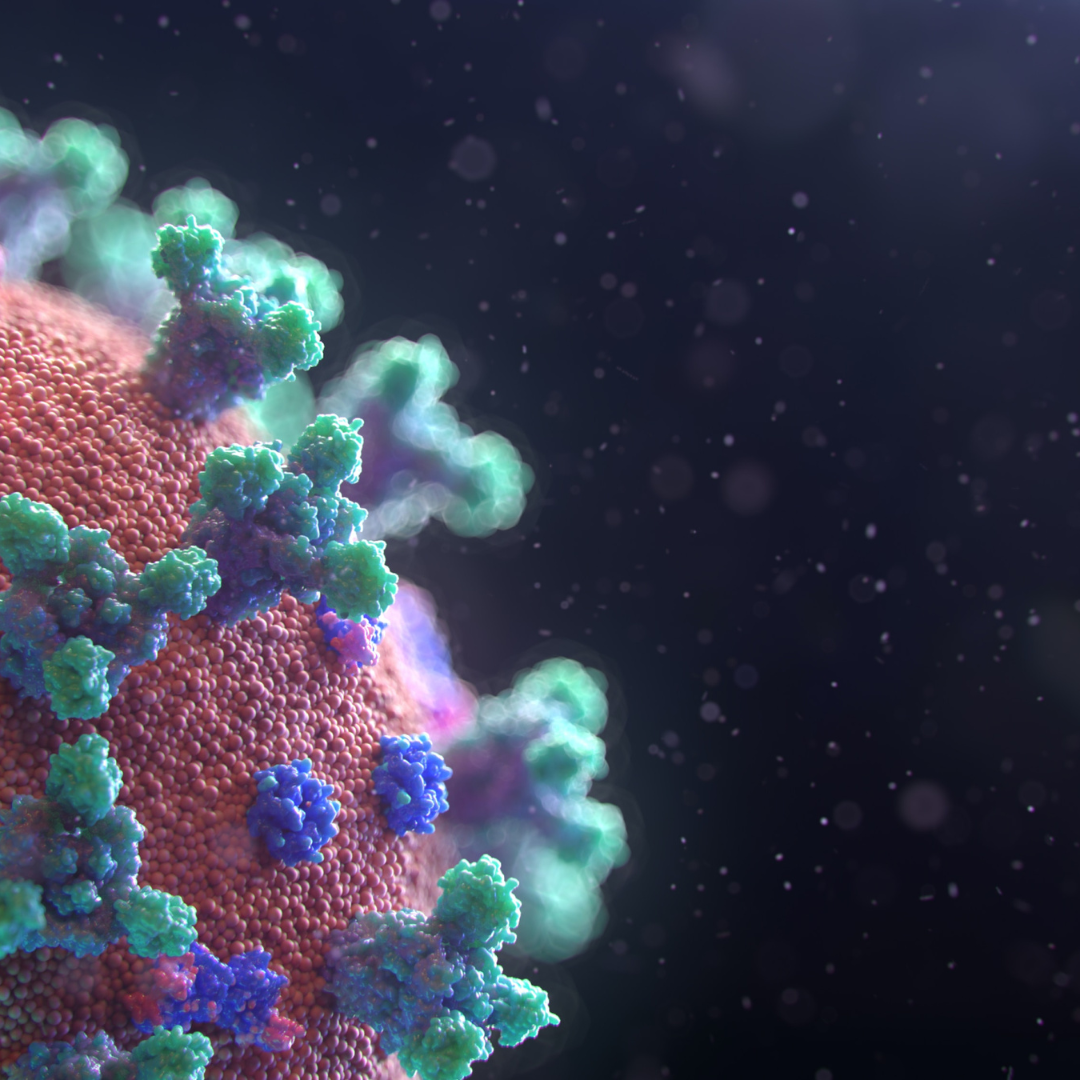

WięcejCancellation of the epidemic emergency means that the employer needs to take additional measures in the HR area

Some provisions of the COVID-19 special purpose act, which provide for special privileges and facilitations for employers during an epidemic, will cease to apply.

WięcejNational e-Invoice System (KSeF) getting closer

On May 9, 2023, the government adopted the National e-Invoice System (KSeF) project. Following public consultations, several changes have been made compared to the originally proposed project.

WięcejNew vehicle mileage rates

Mileage rates are being increased for the first time since 2007. This is a result of high inflation, as well as the rising cost of operating cars, including, among other things, large increases in fuel prices.

WięcejMDR reporting deadline is approaching for domestic tax schemes – and more is to come

The end of the state of epidemic emergency will result in the reinstatement of some tax deadlines previously suspended or extended.

Więcej